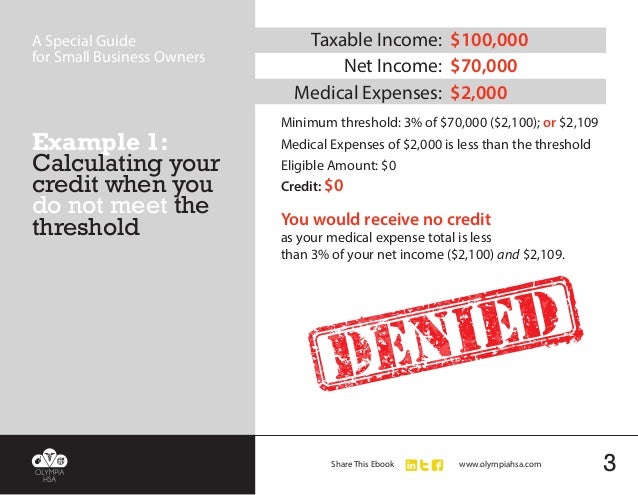

Only those who itemize their deductions are eligible to claim any medical expenses on Schedule A. Taxpayers with access to group health insurance coverage are seldom able to deduct medical expenses that are not reimbursed on their taxes. What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform With all of the focus on new tax rates after Congress green-lighted tax reform, it's easy to forget that some of the. For example, in order to claim a medical expenses deduction if you're in the 200,000-250,000 AGI range, this means that you had unreimbursed medical expenses for the year in excess of.

They can also include any other services that your health insurance will not cover, such as glasses, crutches, and wheelchairs. Typical medical expenses that you may have to cover that are not reimbursed include copays, coinsurance, and deductibles.Only those who itemize their deductions are eligible to claim any medical expenses on Schedule A, and only those expenses that exceed 7.5% of the taxpayer's adjusted gross income (AGI) can be deducted.

0 kommentar(er)

0 kommentar(er)